child tax credit 2021 october

920 AM MDT October 17 2021. Although the Child Tax Credit CTC has reverted to its original amount of 2000 per child for.

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

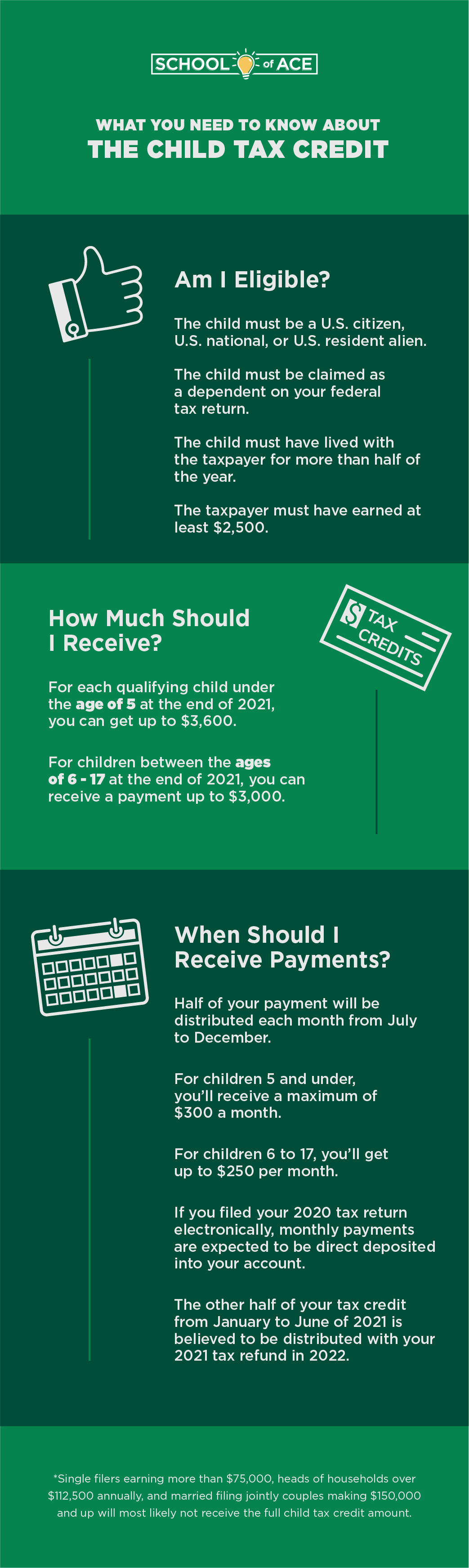

. Half of the Child Tax Credit 1800 or 1500 was distributed between July and December 2021 in six equal payments if a parent or legal guardian chooses to participate. File Your Taxes By October 17 to Claim Your 2021 Deduction. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. Phase-Outs For The 2021 Child Tax Credit. Making the entire credit refundable.

Child Tax Credit. 1052 AM PDT October 15 2021. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days.

The monthly payments were up to 250 or 300 per child for a period of six. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. Child Tax Credit.

CTC Update 2023 is one of the most anticipated announcements by many families in the United States. The Child Tax Credit reached. Families can still claim up to 3000 for each child under six years old and 3600 per child between six and seventeenWith high prices and the ongoing pandemic the 2021 expanded.

Here is everything you need to know about the child tax credit and other. Change language content. The government says some families may be leaving up to 3600.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. The increased Child Tax Credit has two. 150000 for a person.

150000 if you are married and. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. File Your Taxes By October 17 to Claim Your 2021 Deduction.

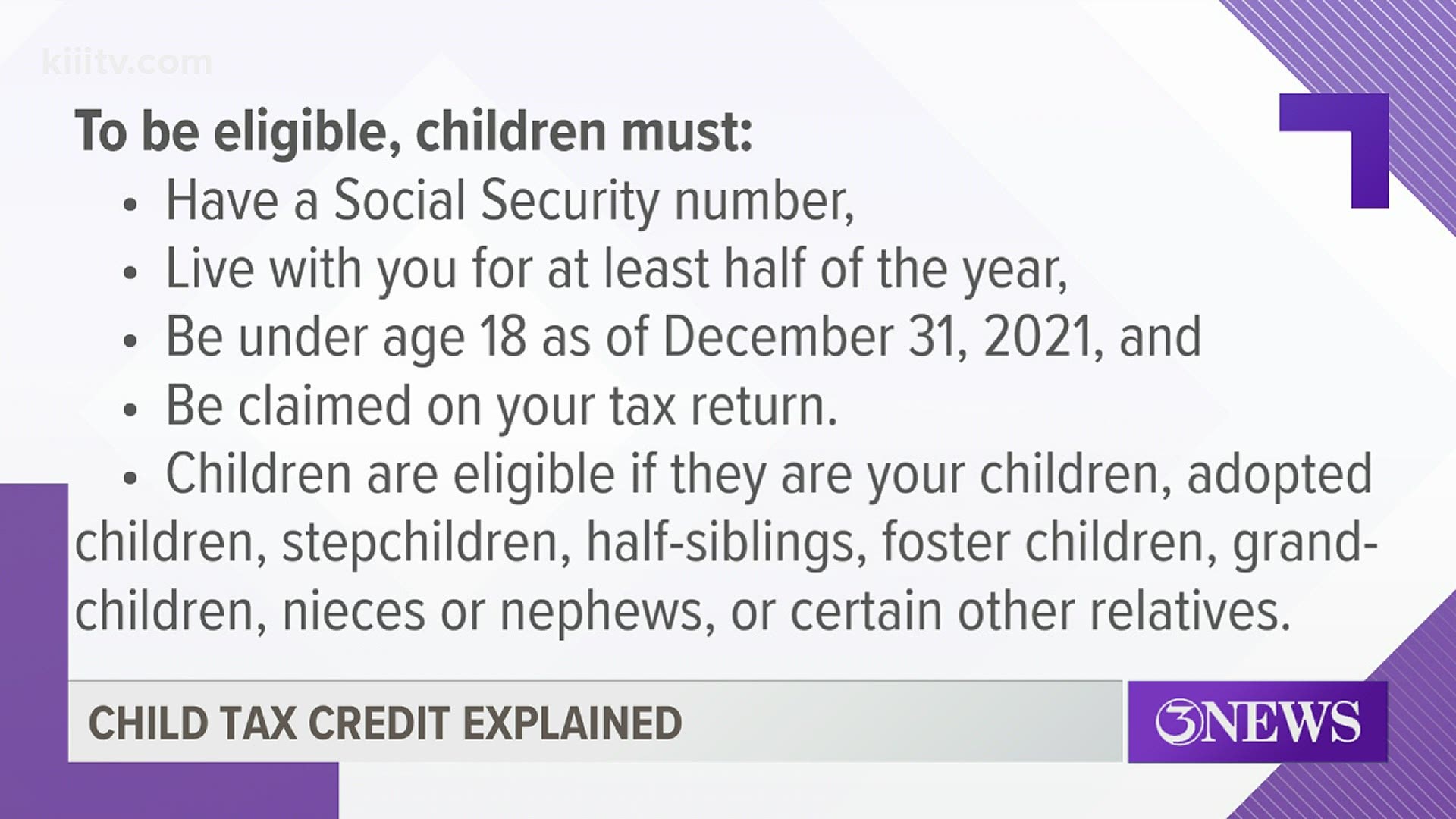

Not all families will be eligible for the full higher Child Tax Credit. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6.

The existing credit of 2000 per child under age 17 was increased to 3600 per. 1 day agoAdvance payments of the enhanced child tax credits were sent to people from July to December 2021. Although the Child Tax Credit CTC has reverted to its original amount of 2000 per child for.

Tax Relief Being Mailed to Eligible New Yorkers 475 million in additional New York State child and earned income tax payments is being sent to about 18 million people. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. 1252 PM CDT October 15 2021.

Written By Barbara Lantz. The child tax credits are worth 3600 for kids below six in 2021. That depends on your household income and family size.

The tax credit was originally offered through President Joe Bidens 19 trillion coronavirus relief package. The child tax credit was temporarily expanded through the American Rescue Plan Act in 2021.

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

What You Need To Know About The Child Tax Credit

How To Get The Child Tax Credit Massachusetts Jobs With Justice

Taxpayer Advocate On Twitter If You Ve Moved Update Your Address By Midnight Eastern Time On October 4th To Change Your Mailing Address For Your October Advance Child Tax Credit Payment Use The

Child Tax Credit Update Here S When Your 300 Payment Will Deposit On October 15 The Us Sun

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit File Your Taxes By October 17 To Claim Your 2021 Deduction Gobankingrates

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Families Will Soon Receive Their December Advance Child Tax Credit Payment

Child Tax Credit Eligibility Kiiitv Com

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

The Irs Sends Monthly Payments To Parents Starting In July Wfmynews2 Com

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The 2021 Child Tax Credit John Hancock Investment Mgmt

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Is The Child Tax Credit And How Much Of It Is Refundable

When To Expect Next Child Tax Credit Payment And More October Tax Tips